Avoid These 4 Common but COSTLY Retirement Income Mistakes

There are no pay stubs in retirement and no accounting departments to answer your questions. Once you retire, you need to be prepared to generate income and use it to pay your bills in a money-savvy manner.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As you near retirement, it becomes clear the responsibility for most aspects of your financial life will fall squarely on your own shoulders. The paychecks you earned will now be replaced by the paychecks you create. For most, those paychecks will need to last for years and cover various expenses throughout our retirement.

Unfortunately, the mistakes you make with your retirement income can have devastating consequences for even the best laid plans.

Consider these four common mistakes to avoid:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Mistake #1: Not Having a Budget Specific to Retirement

This may seem obvious, however, it’s probably much more common than you realize. When teaching retirement courses, I ask our students how many have formalized budgets as their guide to track monthly expenses. I’m always shocked by how few actually have anything more than a budget “in their head.”

Many of those who do have something in place did not make the appropriate adjustments for retirement. Using old assumptions like “you will only need 80%” of your pre-retirement income can be dangerous, especially if you plan to be more active in those early years. Take time to understand what your fixed monthly expenses will be once you retire, along with your anticipated discretionary spending for things like travel, leisure or just spoiling the grandkids.

Without a clear budget, how will you (or your financial adviser) be able to make some of the most important retirement decisions you face, such as when to begin taking Social Security benefits, choosing the right pension elections or determining what mix of investments, insurance or banking products are appropriate for you? The answer is you CAN’T.

Mistake #2: Not Having a Written Income Plan

A written income plan is a MUST. Similar to a budget, most people never have an actual income plan during their working years because their paycheck was their income plan. Earning money and accumulating wealth is often the primary focus throughout our careers. In retirement, the responsibility now falls on you to create your own monthly paycheck from your basket of resources, including Social Security benefits, pensions, CDs, investments, annuities, etc.

A well-designed written plan should bring clarity as to when, how much and from which sources income is needed to cover fixed expenses and discretionary spending. It should also identify what percentage of your fixed monthly expenses will be covered by fixed sources of income, such as Social Security and pension, sometimes referred to as your Income Security Score. The goal should be to get this score as close to 100% as possible to avoid your monthly income being dependent on market performance.

Just like a retirement budget, a written income plan will help you make better decisions about the timing of taking retirement benefits and best combination of investments and insurance products to fill in any gaps or shortfalls.

Mistake #3: Co-Mingling Your Money

The idea of separating your money based on its purpose works in concert with creating a written income plan (see above). As your written plan begins to take form, you should be able to identify gaps, such as the amount of your monthly expenses that are not covered by fixed sources of income, such as Social Security and pensions. Combined with your other retirement needs and desires, you can now begin to allocate your resources appropriately based on purpose.

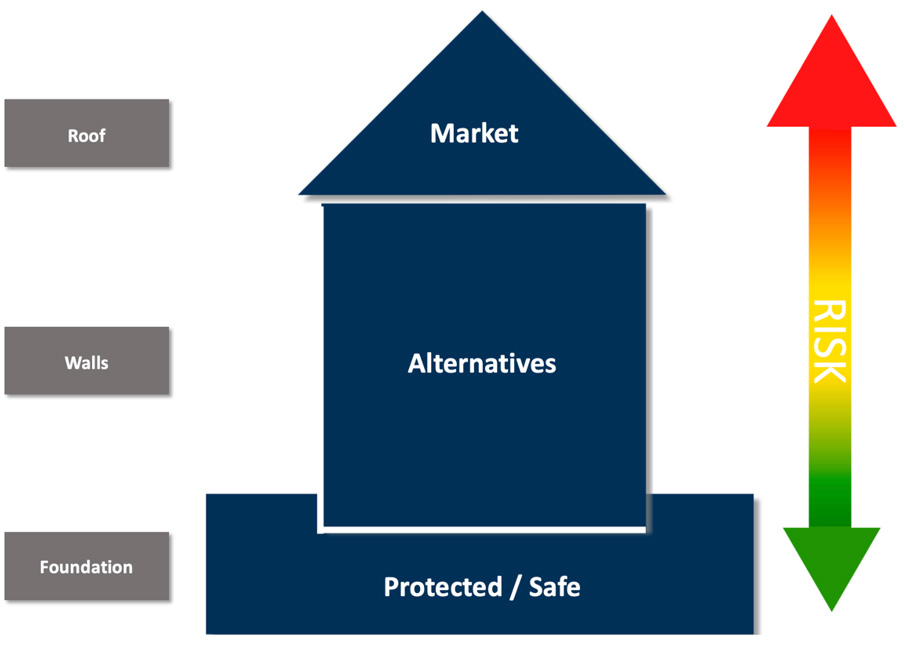

The visual of a house can demonstrate this concept:

In this example, there are three areas with different purposes, typical to many retirees.

- The foundation represents safety and would include things such as your Social Security benefits, pensions, CDs and annuities. It’s from this segment you should create your monthly income.

- The walls of the house could be dedicated to things such as health care and inflation and could include using tools like alternative investments, real estate or life insurance.

- The roof represents the growth piece of retirement and may be dedicated to market-based investments, such as stocks, mutual funds or ETFs.

REALIZE that how much is allocated to each section is completely different for everyone. For example, retirees whose benefits include multiple sources of fixed income may dedicate more of their money to risk-based solutions, compared with someone whose only source of guaranteed income may be from monthly Social Security. A lack of guaranteed* monthly income may require more to be allocated to different tools such as CDs or annuities. There is never a one-size-fits-all solution.

Mistake #4: Taking Regular Distributions from Fluctuating Accounts

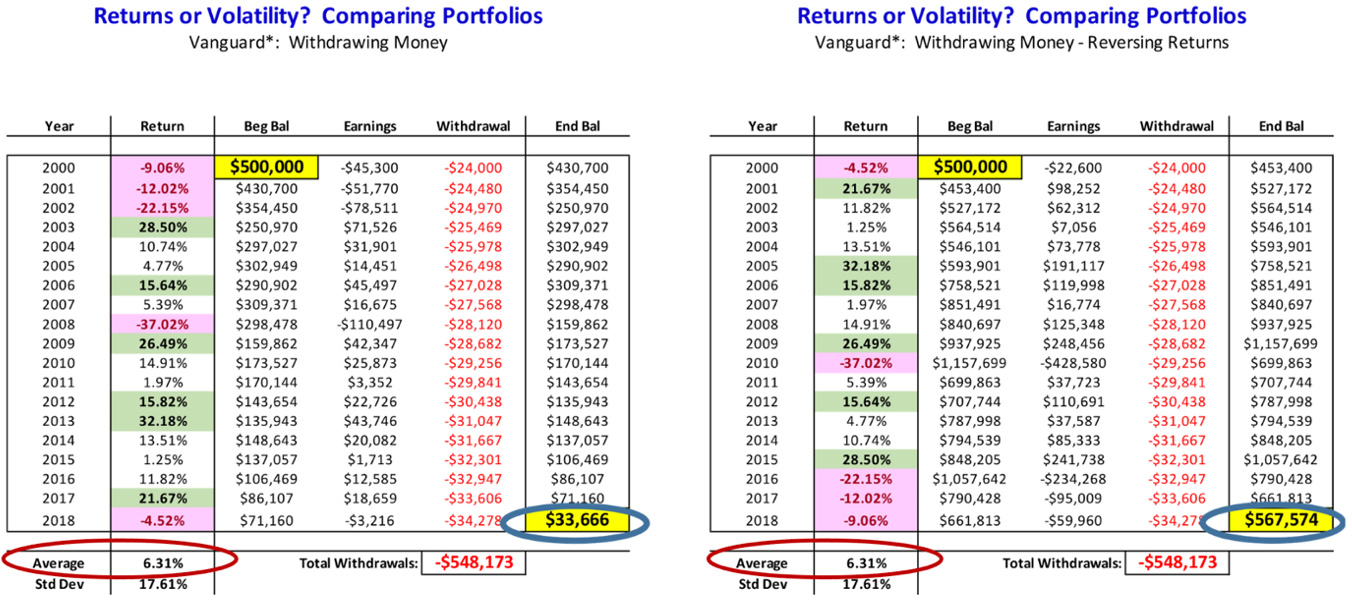

This is probably the most dangerous thing a retiree can do when creating monthly income, because they are now at the mercy of the returns in the market and something called sequence of returns risk. This is all about the order in which the market returns hit your portfolio once you retire. It’s random and unpredictable and can have devasting consequences if left to chance, as this example** shows.

These two portfolios are exactly the same except the order of actual market returns was reversed in the second example. It’s here that you can see the importance of separating your money by purpose to avoid relying on recurring distributions from something so random. This is certainly one of the biggest risks many retirees will face during their retirement but often one of the areas most often left to chance.

Avoid these common mistakes to enjoy all that your retirement can offer!

*Annuity guarantees are backed by the financial strength and claims paying ability of the issuing insurance company. Financial products and services if recommended may include investment advisory fees, commissions and/or other charges.

**This sample portfolio illustration is hypothetical only. It is not intended to represent any particular investment or performance. The above spreadsheet is for illustrative purposes only and does not represent any specific investment recommendation. Investing involves risk and loss of principal. Past performance is no guarantee of future results.

Investment Advisory Services offered through Trek Financial, LLC, (Trek) an SEC Registered Investment Adviser. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 21-115.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nicholas Toman, CFP®, is a lead retirement planner and investment adviser with Empowered Financial Management, a firm that specializes in retirement planning for those individuals within five to seven years of retirement or who have recently retired and no longer wish to serve as their own financial adviser. Nicholas is a graduate of the University of Wisconsin-Whitewater with a BBA in accounting and has been a Certified Financial Planner since 2014.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.