Move Over ETFs: Direct Indexing Is an Investment Strategy Worth Paying Attention to

More flexibility, more control, the potential for higher returns and tax-reducing strategies: With pros like that, could direct indexing be right for you?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Recently, direct indexing, a lesser-known investment approach, has started outpacing both ETFs and mutual funds in investor adoption. Direct indexing offers unique benefits that can’t be replicated in a traditional ETF or mutual fund structure, particularly around personalization and tax management.

Given its benefits, direct indexing is expected to continue to outpace ETF and mutual fund growth over the coming years according to a recent Cerulli report. Here’s what you need to know about this growing investment method.

What is direct indexing?

Direct indexing is an investment strategy where an investor holds individual stocks that make up an index in their own account directly, instead of using a mutual fund or ETF to track the underlying index. Similar to an index fund, the goal is to track the performance of a target benchmark index. However, when an investor holds the individual securities directly in their account, it allows for more personalization and the potential for greater tax benefits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Direct indexing has been the core of many high-net-worth clients’ strategies for decades. It’s no surprise, given its unique benefits, particularly around taxes. Offered mostly through financial advisers, investment minimums for direct indexing are often $250,000 or more. However, no-commission trading and fractional shares have made the strategy more broadly accessible, with minimums at or below $5,000 in some cases.

A lower tax bill

With hundreds of individual stocks held in a direct indexing portfolio, there are extensive opportunities for tax loss harvesting – the practice of selling a security at a loss to offset capital gains. Even in up markets, individual stocks can have bouts of poor performance. Direct indexing portfolios can take full advantage, harvesting losses in underperforming stocks even as the market as a whole is up. This can mean 1% or more in additional after-tax returns, according to recent research from Vanguard.

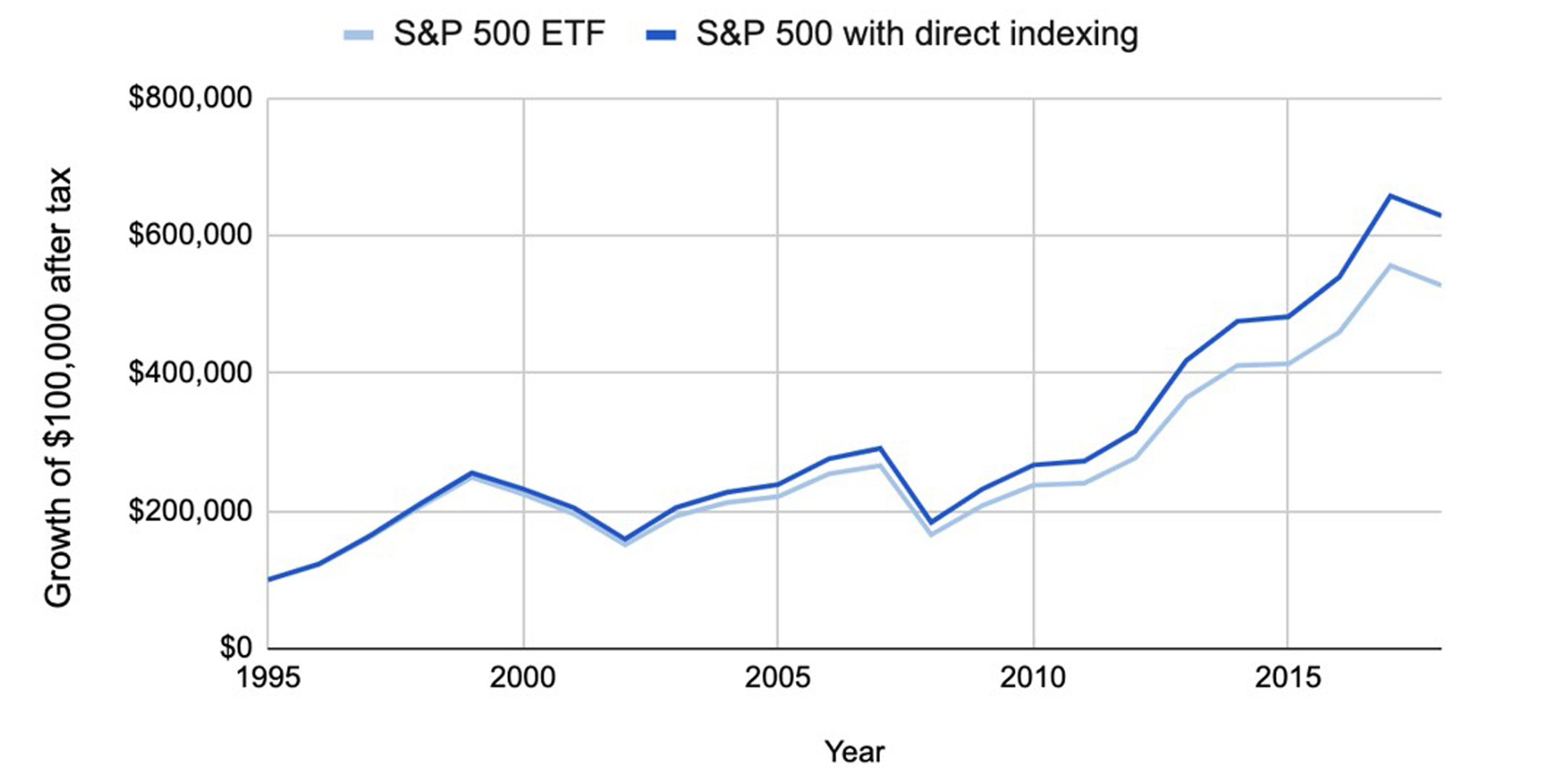

A separate study looked at historical returns over the last century and found that direct indexing added 1.08% annually in after-tax returns. From 1995 to 2018, the most recent period studied, an investor using a direct indexing strategy to track the S&P 500 would have seen their $100,000 initial investment grow to about $630,000 after accounting for taxes. That’s $101,000 more than they otherwise would have had.

Note: The dark blue line in the graph represents the after-tax value of a portfolio that tracks the S&P 500 using direct indexing and employs a tax loss harvesting strategy. By comparison, the light blue line represents the after-tax value of an ETF that tracks the S&P 500.

Sources: Chaudhuri, Burnham, Lo 2020; author’s calculations.

The flexibility of direct indexing also allows for portfolios to be built around existing holdings. This becomes particularly important when a portfolio has embedded gains in concentrated positions. In such a case, an investor can diversify around existing positions while managing any potential tax impact from liquidating positions.

Pinpoint personalization

By holding securities in their own accounts, investors are free to customize portfolios as they see fit. Such customization is not possible in a fund, as each investor has exposure to the same set underlying securities as every other shareholder.

Direct indexing portfolios can tilt toward ESG factors, or exclude securities that do not align with an investor’s values. Because this can be done at the individual account level, investors don’t need to compromise on their values when building their portfolio. Additionally, holding individual stocks allows shareholders to participate directly in proxy voting, another source of control for investors.

Personalization affords another important benefit: better behavior. It’s often easier to not overreact in a down market and stick to a savings plan when your investments reflect your values.

Too much personalization, however, can cause direct index performance to deviate – positively or negatively – from the target index. Every investor has their own tolerance for risk and performance, and investors should be aware that there is a tradeoff between customization and tracking the benchmark index.

Is direct indexing right for me?

One of the main advantages of direct indexing is that it can generate additional capital losses. Capital losses are most useful when an investor has capital gains to offset from other investments. For investors with little or no outside capital gains, the tax benefits afforded are more limited.

Additionally, direct indexing has more moving parts than a portfolio that uses funds. Holding individual securities and trading them for tax loss harvesting means more transactions to account for at tax time.

For many, direct indexing will be the future of investing

Direct indexing strategies are growing faster than other investment vehicles. And for good reason, the strategy offers benefits that are difficult or impossible to replicate using a fund. Recent innovations, like fractional share trading, have lowered the barrier to entry to direct indexing portfolios.

A once rarified investment strategy is now poised for broader adoption and with it the potential to generate better outcomes for many investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Grealish serves as Head of Investments at Altruist, a fintech company on a mission to make great independent financial advice more affordable and accessible. With a career rooted in financial innovation, Adam most recently led Betterment's strategic asset allocation, fund selection, automated portfolio management, and tax strategies. In addition, he served as a vice president at Goldman Sachs, overseeing the structured corporate credit and macro credit trading strategies.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.