Entrepreneurs, 3 More To-Dos Before Year End 2021!

To keep your business sharp and on track into 2022, take a second to check off these three often-overlooked to-do items.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Adding another item to your to-do list before the end of the year may be the last thing that you want to think about, unless of course it is going to positively impact your wallet or your mind.

The last few years have been anything but normal, and based on that we have identified three to-dos for you to consider as we close in on 2022. If you are one of the lucky few who have already addressed each of these areas, congratulations, you are doing a great job, and all the best to you and your company for a strong close to 2021.

1. Review your business’s estimated quarterly income tax payments!

Contact your income tax professional to run a forecast of your year-end revenue and expenses. What is your estimated net income going to look like by Dec. 31, 2021, compared with 2020? Do you have a wide gap when comparing your estimated income tax payments against your estimated income taxes due?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

2020 was an outlier year — for some company’s revenues were down since then, but many other businesses saw their revenues increase. In the illustration below for “ABC Corp.,” you will see that ABC has had a large increase in net income for their business in 2021 vs. 2020. ABC has not adjusted their estimated quarterly income tax payments throughout the year — which could lead to a nasty tax surprise.

To-do #1: Contact your income tax professional to compare your estimated quarterly tax payments against your estimated income taxes due. Are you prepared?

2. Determine whether you are maximizing your retirement plan deductions.

Should you consider revising your retirement plan for your company? Prior to selecting a retirement plan, seek the guidance of a qualified professional, as each plan has its own requirements and protocol to follow.

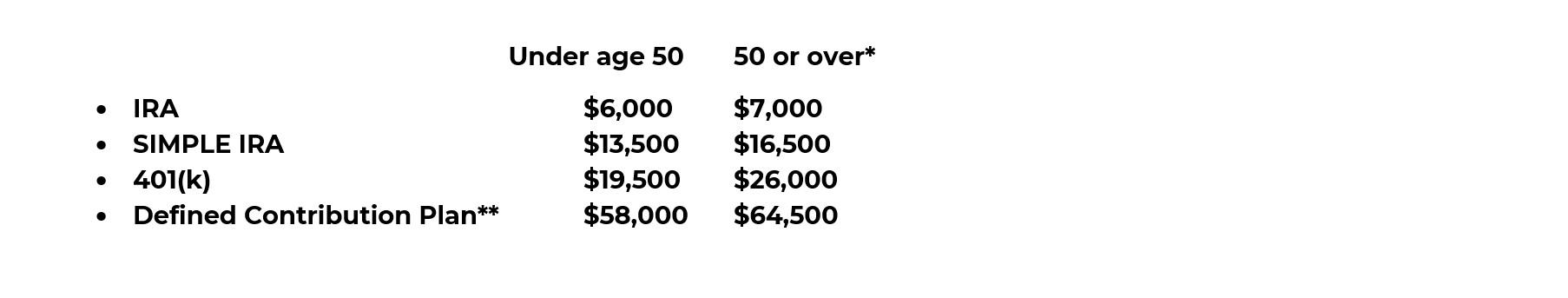

Key items, such as when you can make changes to your plans, plan limits, maximums and calendar year deadlines, all need to be taken into consideration prior to doing anything. Once you have completed your diligence, if you are looking for ways to offset net income with an income tax deduction, several retirement plans can be reviewed. Below, find the maximum contributions limits for 2021 on four common retirement plans, of course many others exist that may suit your needs:

*If you are 50 or older, you are allowed an additional retirement contribution that exceeds the statutory limit, known as the “catch-up” contribution.

** Includes profit sharing or money purchase pension plans.

To-do #2: Review your retirement plans. Are you contributing to the plan that is best for you and your company’s situation? Are you taking into consideration the maximum contribution limits in your planning?

3. Take time to reset and refocus.

Abraham Lincoln once said, “Give me six hours to chop a tree, and I will spend the first four sharpening the ax.” The past few years have been especially interesting, and our thinking has been stretched to accommodate the pandemic. The additional responsibilities, creative thinking and keeping our minds on business solutions have put strain on all of us.

Taking time to “sharpen your ax” will keep you fresh, on your game and solid with your decisions.

To-do #3: Perform a mental reset by asking yourself a few questions about your business:

- What did I learn from 2021? What worked? What didn’t?

- Is my vision “still” aligned with my priorities?

- What can I take from 2020 and 2021 to make 2022 my best year?

Although, to-dos are not typically something we get excited about, reconfirming the ideas above could save you time, money and reconfirm your focus and energy going into 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dennis D. Coughlin, CFP, AIF, co-founded CG Capital with Christopher C. Giambrone in 1999. He has been in practice since 1996 and works with individuals nearing retirement and those whom have already retired. Proud of his humble upbringing, Dennis shares his advice with the same core principles that he was raised with. When not in the office, you will find him with his family enjoying the outdoors.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.