8 Steps to Appeal Your Property Tax Bill

Home values are rising across the country, which means many homeowners’ property taxes are now going up, too.

Many homeowners have seen their property values shoot up as the pandemic sparked a frenzied housing market. If you’re envisioning big proceeds when you sell your house, rising home prices are a cause for celebration.

But you may not feel like popping the champagne when you get your property tax bill. As home prices climb, property taxes follow suit. Your tax bill is determined by multiplying your home’s assessed value by the local tax rate.

Homeowners will see higher taxes in 2022 and beyond as localities reassess property values, although the pain should ease as price appreciation slows. Kiplinger expects housing demand to cool, with home prices lifting by 3% in 2022. And keep in mind that local tax rates affect your bill, too. If your municipality lowers rates to provide relief or stay within required levels, your bill may fall or show only a modest increase.

But if your property tax bill has increased significantly, you may have grounds for an appeal, particularly if the increase seems out of line with overall appreciation in your area.

Most jurisdictions give you 90 days after you receive a new assessment to appeal, although some close the appeals window after 30 days, says Pete Sepp, president of the National Taxpayers Union. Some lawyers handle property tax appeals on a contingency basis, but most homeowners can appeal on their own, Sepp says.

Plenty of property owners challenge their assessments each year, and between 20% and 40% of them win lower assessments and lower property tax bills. The following steps will show you the way to success.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Step 1: Know the Rules

Schedules vary, but local governments commonly send assessment notices to homeowners in the first few months of the year. As soon as you get yours—or even before—check the deadline for challenging the value. You may have just a few weeks. And be sure you know how your locality assesses property.

Some set the tax assessment at a percentage of market value, 80%, for example, so don’t feel smug if you get a $90,000 assessment on a home you think is worth at least $100,000—everyone in your jurisdiction should get the same treatment.

Depending on how frequently your community reassesses home values, you may not see a sizable increase in your tax bill right away. Some areas refresh values annually, while others do so every other year or every few years.

Step 2: Check for the Property Tax Breaks You Deserve

When you get your property tax bill, check it for your tax rate, assessment figures and payment schedule, and make sure that all the reductions you’re entitled to are itemized.

Some states allow anyone who owns and lives in a primary home to shield a portion of its value from taxation. You may be eligible for credits based on your income or status as a senior citizen, veteran or disabled person. In Florida, for example, all homeowners are eligible for a homestead exemption of up to $50,000; those 65 and over who meet certain income limits can claim an additional $50,000.

Other tax breaks come in the form of freezes or deferrals. In Arizona, homeowners age 65 or older who have lived in their primary home for at least two years and meet income limits can have their property’s valuation frozen for three years.

Rebates and other property tax breaks aren’t automatic: you usually have to apply for them and show proof of eligibility. Contact your state’s department of taxation or visit its Web site to see what breaks are available to you.

Step 3: Go Set the Record Straight

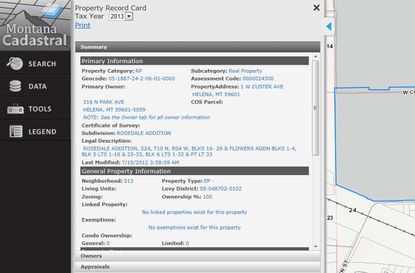

Check your property’s record card. You can often it verify it on your locality’s website, although in some jurisdictions you may have to go to the assessor’s office to view property cards or request to receive the information by e-mail or fax, says Greg McHenry, appraiser for Riley County, Kan., and president of the International Association of Assessing Officers.

This record is the official description of your house, and if you see an outright error—say, four bedrooms and three-and-a-half bathrooms for your two-bedroom bungalow, for example—the assessor may fix the problem on the spot, reduce the assessed value and your tax bill. That’ll save you the trouble of a formal appeal.

Step 4: Check the Comparables

We’d never tell you to keep up with the Joneses, but comparing your property to similar ones in your neighborhood will determine whether you have a solid case.

Pull up property cards of several homes of similar age and square footage and with the same number of bedrooms and bathrooms to see how their assessments line up with yours.

Search in your area for recent sale prices of homes similar to yours on a website such as Zillow.com or Realtor.com. Any sales that occurred in the past few months may have taken place after your assessor’s latest property evaluation.

Step 5: Gather Evidence and Build Your Case

If you find that your assessed value is considerably higher than several similar homes or that sale prices of nearby homes suggest that your property’s value is lower than estimated, you may have grounds for appeal. But even if your assessment falls into the middle of the pack, it’s not necessarily fair. Maybe your house has a leaky basement or lousy grading that doesn’t allow you to have a garden. The assessment should be based on the market value of your home; if your place has issues that would turn off buyers, now’s the time to own up to them.

Step 6: Fight Hard, but Politely

The process varies by locality, but you’ll likely send your appeal and your evidence—data on comparable properties, blueprints, photographs, repair estimates—to the assessor for review. You should get a verdict within a couple of months.

If you’re dissatisfied, take your case to the appeals board and put your persuasive skills to work. Don’t whine, and save your opinions on politics and tax rates for elected representatives who vote on those matters.

Step 7: Consider a Professional Appraiser

If you don’t have time, or the stomach, to do battle yourself, get a hired gun to do the legwork for you. A professional appraiser can provide the strongest evidence of your property’s worth. If your community allows outside appraisals—and if you’re willing spend at least $250—find an appraiser with national certification, such as through the Appraisal Institute or the American Society of Appraisers. Don’t fall for solicitations from law firms or other services saying they’ll assist you in return for a high percentage of the savings on your bill—it’s not worth the cost.

Step 8: Reap the Rewards!

If you need added incentive to bring a skeptical eye to your real estate appraisal, remember this: A successful appeal is truly the gift that keeps on giving, year after year. Raise a toast to your success.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

-

Is a Phased Retirement Right for You?

Is a Phased Retirement Right for You?Want to keep working, just not as hard? A phased retirement may just be the answer.

By Kimberly Lankford Published

-

Four Tips to Make Your Sales Presentation a Winner

Four Tips to Make Your Sales Presentation a WinnerBeing prepared and not being boring can go a long way toward persuading a potential customer to buy into what you’re offering.

By H. Dennis Beaver, Esq. Published

-

12 Places to Retire If You're Sick of the Heat

12 Places to Retire If You're Sick of the Heatplaces to live Some like it hot; others not so much. Here are the 12 best places to retire if you can't stand the heat.

By Stacy Rapacon Published

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome Now that fall is officially here, it's time to prepare your home for cold weather.

By Donna LeValley Published

-

10 Things You Need to Know About Retiring to Florida

10 Things You Need to Know About Retiring to FloridaMaking Your Money Last If Florida is part of your retirement plan, we offer up a few tips to help you find your way.

By Bob Niedt Last updated

-

Hurricane Insurance Claims: 10 Things You Should Know

Hurricane Insurance Claims: 10 Things You Should KnowBecoming a Homeowner Hurricane damage? Know what’s covered, what isn’t, and how to make the most of your policy if you need to file a claim.

By Kimberly Lankford Last updated

-

10 States With the Lowest Sales Tax

10 States With the Lowest Sales TaxSales Tax Living in one of the lowest sales tax states doesn't always mean you'll pay less.

By Katelyn Washington Last updated

-

5 Great Places to Buy a Vacation Home

5 Great Places to Buy a Vacation HomeWant a vacation home for remote work or a fun getaway? Here are locations with median prices under $400K.

By Ellen Kennedy Last updated

-

10 Big U.S. Cities With the Cheapest Apartment Rents

10 Big U.S. Cities With the Cheapest Apartment Rentsplaces to live Apartment dwellers pay less than the national average in these cities with the cheapest rent.

By Dan Burrows Last updated

-

The 10 Most Expensive Cities to Live in the U.S.

The 10 Most Expensive Cities to Live in the U.S.Real estate From metro areas on both coasts to the middle of the Pacific Ocean, these are the most expensive cities to live in the U.S.

By Dan Burrows Last updated