7 CARES Act Tax Breaks for Businesses

No matter what business you're in, there's probably at least one CARES Act tax breaks that can improve your bottom line and help you stay afloat.

While stimulus checks, small business loans and expanded unemployment benefits have gotten the lion's share of media coverage, there are also a number of important business tax breaks in the Coronavirus Aid, Relief, and Economic Security (CARES) Act that haven't received a lot of attention. Most of the new tax breaks are only temporary. Several of them tweak or reverse changes made by the 2017 tax reform law. All are designed to get coronavirus-ravaged businesses and workers back on their feet as quickly as possible. No matter what business you're in, at least one of these seven tax breaks is likely to improve your bottom line and help you stay afloat.

(For information on new business tax credits for providing paid sick and family leave benefits, which were enacted as part of the Families First Coronavirus Response Act, see Tax Credits Included in Coronavirus Paid Leave Law.)

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Charitable Gift Deduction Expanded

Normally, a corporation can't deduct charitable contributions that exceed 10% of its taxable income for the year. Any amount over the 10% limit can be carried over for up to five years. Under the CARES Act, the taxable income limit on 2020 charitable gifts of cash rises to 25%.

The CARES Act also increases the limitation on deductions for 2020 contributions of food inventory from 15% to 25%.

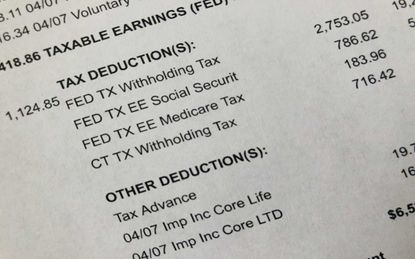

Payroll Tax Payment Delayed

Employers can defer payment of their 6.2% share of Social Security tax on wages paid from March 27 through December 31, 2020. Half of the deferred amount is due on December 31, 2021, and the other half on December 31, 2022. Self-employed people can defer 50% of the self-employment tax they owe.

This relief does not apply to businesses that receive a Small Business Administration (SBA) paycheck protection loan under the CARES Act and have that debt forgiven for retaining their employees.

Payroll Tax Credit

There's a new payroll tax credit for employers hurt by the coronavirus…but the business must retain and continue to pay workers to claim this tax break. The credit of up to $5,000 per paid employee offsets the employer's 6.2% share of Social Security taxes, with the excess refundable. Eligible employers are those who have to close up shop or reduce hours because of a governmental order, or whose gross receipts in a quarter have declined by more than 50% compared to the same quarter in 2019.

The credit only applies to qualified wages paid from March 13 through December 31, 2020. Qualified wages depend on the number of employees the business had in 2019. If the firm averaged more than 100 full-time employees, qualifying wages are wages paid when employee services are not provided. For smaller firms, all wages are eligible for the credit.

Employers with cash flow problems can get this credit quickly by reducing employment tax deposits otherwise owed to the IRS by the amount of the credit. Firms can also file new IRS Form 7200 to seek advance payment for credits in excess of payroll tax deposits.

There are lots of rules and complexities involved with this payroll tax credit. One important restriction is that employers who get an SBA paycheck protection loan under the CARES Act are not eligible for the credit. So be sure to check with your tax advisor for assistance with this credit.

NOL Carrybacks Allowed

A business has a net operating loss (NOL) if its deductions for the year are more than its business income. Before 2018, businesses could carry back NOLs to the previous two tax years and carry them forward for up to 20 years. The 2017 tax reform law eliminated the two-year carryback for NOLs arising in taxable years ending after 2017 and allowed such NOLs to be carried forward indefinitely. The reform law also provided that NOL deductions can offset only up to 80% of taxable income for the year.

The CARES Act temporarily eases the tax reform law's NOL provisions. First, NOLs in 2018, 2019 and 2020 can now be carried back up to five years (the carryforward rule wasn't changed). Second, the 80% taxable income limit for utilizing NOLs is halted for 2018 through 2020.

Interest Deduction Expanded

The 2017 tax reform law limited the deduction that large firms can claim for interest on business debt to 30% of adjusted taxable income (ATI), with any disallowed interest carried forward. (The limit doesn't apply if a business's average annual gross receipts are $25 million or less for the three prior tax years. Also, certain regulated utility companies and real estate companies are exempt.) The CARES Act increases the 30% ATI limit. Net interest write-offs are now capped at 50% of ATI for 2019 and 2020. Firms can also use their 2019 ATI for figuring 2020 interest deductions.

Any business interest expense that isn't allowed as a deduction for the year is carried forward to the following year.

Business Loss Deduction Cap Suspended

The cap on the deduction for business losses on individual returns is halted. Under the 2017 tax reform law, the amount of trade or business losses that exceeded a $500,000 threshold for couples and $250,000 for other filers was nondeductible, with any excess carried forward. The CARES Act suspends this loss limitation rule generally for 2018 through 2020.

"Retail Glitch" Fixed

A key technical glitch in the 2017 tax reform law has been corrected. It involves depreciation for restaurant, retail and leasehold remodeling, which is consolidated under the grouping of qualified improvement property (QIP). As part of the 2017 tax reform law, Congress intended to give QIP a 15-year depreciable life and to make it eligible for 100% bonus depreciation. But the statutory language didn't reflect this intent. The CARES Act fixes this flub, retroactive to 2018.

Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

-

Is a Phased Retirement Right for You?

Is a Phased Retirement Right for You?Want to keep working, just not as hard? A phased retirement may just be the answer.

By Kimberly Lankford Published

-

Four Tips to Make Your Sales Presentation a Winner

Four Tips to Make Your Sales Presentation a WinnerBeing prepared and not being boring can go a long way toward persuading a potential customer to buy into what you’re offering.

By H. Dennis Beaver, Esq. Published

-

A Bunch of IRS Tax Deductions and Credits You Need to Know

A Bunch of IRS Tax Deductions and Credits You Need to KnowTax Breaks Lowering your taxable income is the key to paying less to the IRS. Several federal tax credits and deductions can help.

By Kelley R. Taylor Last updated

-

Don’t Miss This $2,500 Tax Break for Paying Your Student Loan

Don’t Miss This $2,500 Tax Break for Paying Your Student LoanTax Deductions Do you qualify for the student loan interest deduction this year?

By Katelyn Washington Last updated

-

Six Tax Breaks That Get Better With Age

Six Tax Breaks That Get Better With AgeTax Breaks Depending on your age, several tax credits, deductions, and amounts change — sometimes for the better.

By Kelley R. Taylor Last updated

-

Biden Proposes New Homebuyer Tax Credits

Biden Proposes New Homebuyer Tax CreditsTax Credits President Biden is calling for new middle-class tax breaks including a mortgage tax credit.

By Kelley R. Taylor Last updated

-

Will Florida Property Tax Be Eliminated?

Will Florida Property Tax Be Eliminated?Property Taxes A new proposal is raising questions about revenue generation in the Sunshine State.

By Kelley R. Taylor Published

-

States That Won't Tax Your EV

States That Won't Tax Your EVState Tax Most states impose additional fees on electric vehicles, but these states don’t penalize EV owners, and some also offer other tax incentives.

By Kelley R. Taylor Last updated

-

Tax Season is Here: Big IRS Tax Changes to Know Before You File

Tax Season is Here: Big IRS Tax Changes to Know Before You FileTax Filing Tax deductions, tax credit amounts, and some tax laws have changed for the 2024 tax filing season.

By Kelley R. Taylor Last updated

-

Your Arizona Family Rebate is Taxable: What to Know

Your Arizona Family Rebate is Taxable: What to KnowState Tax Thousands of Arizona families will need to report income from special child tax relief payments.

By Kelley R. Taylor Last updated