5 High-Yield ETFs to Buy for Long-Term Income

For investors committed to generating income, these five high-yield ETFs could be worth including in your buy-and-hold portfolio.

The Federal Reserve recently suggested that the U.S. economy will shrink by 6.5% – its worst annual performance since World War II. The Fed also expects unemployment to finish the year over 9%.

Those are good reasons to develop a heightened interest in high-yield ETFs (exchange-traded funds). That's because the Fed's key interest rate likely will hover around 0% for the next 24 to 36 months, leaving investors starved for income, while Fed Chairman Jerome Powell uses every tool at his disposal to help restart the economy.

"(The outbreak) will weigh heavily on economic activity. (It) poses considerable risks to the economic outlook," Powell stated June 10. "We're not even thinking about raising rates. We're not even thinking about thinking about raising rates."

That should make it all the more difficult to generate above-average income from equity and bond ETFs in the near to mid-term. Difficult … but not impossible.

Here are five high-yield ETFs delivering at least 4% in annual income that you can buy for the long-term

Disclaimer

Data is as of June 16. Dividend yields represent the trailing 12-month yield, which is a standard measure for equity funds.

Vanguard Real Estate ETF

- Type: Real estate

- Assets under management: $30.1 billion

- Dividend yield: 4.1%

- Expenses: 0.12%

COVID-19 has definitely put real estate investors on edge.

Retail real estate investment trusts (REITs) have been hit by forced closures of non-essential businesses. And as remote working is adopted by American companies on a full-time basis, office REITs might experience some short-term pain (at the least) as the demand for office space slows.

Fortunately, the Vanguard Real Estate ETF (VNQ, $83.40) only invests 8% of the portfolio's $30 billion in assets in office REITs. The top three categories of REITs in VNQ are specialized REITs (42%), residential REITs (14%) and industrial REITs (11%). In total, Vanguard's ETF invests in 12 different real estate categories.

This is a top-heavy fund, however. Of its 183 holdings, the top 10 account for nearly 40% of the fund's assets. Those larger holdings include the likes of American Tower (AMT), Prologis (PLD) and Equinix (EQIX).

There are a few restrictions keeping VNQ from being too lopsided, however. The ETF tracks the performance of the MSCI US Investable Market Real Estate 25/50 Index, which keeps VNQ from investing more than 25% of its assets in a single stock. Further, the stocks weighted at more than 5% can't add up to more than 50% of the portfolio. This provides diversification while limiting the exposure to a single real estate investment.

As for the dividends? REITs are a traditionally income-friendly sector, and a down year for this high-yield ETF has brought the yield above 4%.

Invesco Preferred ETF

- Type: Preferred stock

- Assets under management: $5.6 billion

- SEC yield: 5.3%*

- Expenses: 0.52%

Warren Buffett is one investor that isn't afraid to invest in preferred stocks. Even when it means he might have to wait for a return on his investment.

Preferred stocks are so called "stock-bond hybrids" that trade on exchanges like stocks, but deliver a set amount of income and trade around a par value like a bond. For instance: In 2019, Buffett invested $10 billion in Occidental Petroleum (OXY) preferred stock that paid Berkshire Hathaway (BRK.B) 8% in annual dividends. (Buffett also received warrants to buy 80 million shares of the oil and gas company at $62.50; unfortunately, falling oil and gas prices have put that investment into question.)

Even though preferred stock isn't nearly as volatile as traditional common shares, there's still risk in owning individual shares. A fund such as the Invesco Preferred ETF (PGX, $14.32) is an excellent way for investors to generate above-average income while maintaining a diversified portfolio of preferreds.

PGX tracks the performance of the ICE BofAML Core Plus Fixed Rate Preferred Securities Index, which invests at least 80% of its assets in fixed-rate U.S. dollar-denominated preferred securities. These securities have a minimum average credit rating of B3 (well into junk territory), but almost two-thirds of the portfolio is investment-grade. The portfolio is reconstituted and rebalanced on a monthly basis.

Invesco Preferred ETF's nearly 300 holdings are most heavily concentrated in financials (63%), followed by utilities (14%) and real estate (9%). Energy is 2% of the portfolio, but Occidental isn't included.

* SEC yield reflects the interest earned after deducting fund expenses for the most recent 30-day period and is a standard measure for bond and preferred-stock funds.

SPDR Portfolio S&P 500 High Dividend ETF

- Type: Large value

- Assets under management: $2.0 billion

- Dividend yield: 6.4%

- Expenses: 0.07%

The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either in or near bankruptcy – a quick way to make a bundle or lose your shirt. But Robinhood users also hold plenty of more stable investments, including ETFs.

The SPDR Portfolio S&P 500 High Dividend ETF (SPYD, $29.77) is held by 25,828 accounts, making it one of the most popular high-yield ETFs on the site and the 15th most-held ETF among Robinhood account holders as of this writing.

What makes SPYD special?

Cost is no doubt a factor. State Street charges a management expense ratio of just 0.07%, making it one of the 100 least expensive ETFs in the U.S. If fees matter, and they should, SPYD is an excellent possibility.

A second attractive feature of the ETF is that it tracks the performance of the S&P 500's 80 highest-yielding companies. If you're looking for income, capital appreciation, and relative safety, it's hard to beat SPYD.

The fund's tracking index is the S&P 500 High Dividend Index excludes any stocks under $8.2 billion in market value. Further, the weighted average market cap of the 64 holdings is $50.2 billion. Top holdings include the likes of Gilead Sciences (GILD), General Mills (GIS) and AbbVie (ABBV).

If you're interested in smaller companies, this isn't the ETF for you.

WisdomTree International SmallCap Dividend Fund

- Type: Foreign Small/Mid Value

- Assets under management: $1.3 billion

- Dividend yield: 4.5%

- Expenses: 0.58%

The WisdomTree International SmallCap Dividend Fund (DLS, $57.00) is the third-largest of WisdomTree's 22 international ETFs with total assets of $1.3 billion. It tracks the performance of the WisdomTree International SmallCap Dividend Index, which consists of stocks with market caps in the bottom 25% of the WisdomTree International Equity Index, after removing the 300 largest companies.

Investors might shy away from this ETF because the roughly 900 components are based outside the U.S. and Canada. Further, some might consider it unusual to have a dividend focus when investing in smaller companies. However, WisdomTree has had great success over the years with international small caps.

"At WisdomTree, we believe that dividends provide an objective measure of a company's health and profitability – one that cannot be affected by accounting methods or government decisions," WisdomTree argues. "We have been weighting by dividends since WisdomTree launched its first ETFs in 2006."

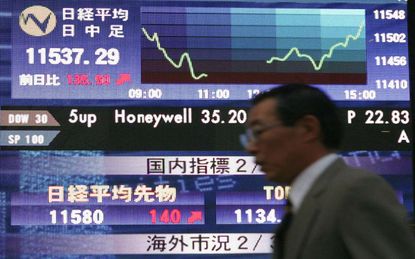

The ETF's top three country allocations are Japan (34%), Australia (11%) and the United Kingdom (9%). The top three sectors are industrials (20%), financials (16%) and consumer discretionary (14%).

The top 10 holdings account for just 6.0% of the portfolio, and the average weighting is 0.11%, which are both great signs of diversification – something else you might consider important when investing in small-cap stocks.

Xtrackers USD High Yield Corporate Bond ETF

- Type: High-yield bond

- Assets under management: $5.3 billion

- SEC yield: 4.8%

- Expenses: 0.15%

The Xtrackers USD High Yield Corporate Bond ETF (HYLB, $47.82) is the only fixed-income fund in this list of high-yield ETFs, which makes sense given how low yields have been driven on many other types of bonds.

HYLB, which tracks the performance of the Solactive USD High Yield Corporates Total Market Index, has gathered $5.3 billion in total net assets – a good amount by broad ETF standards.

It's far smaller than some of the largest U.S.-listed fixed-income ETFs, such as the iShares Core U.S. Aggregate Bond ETF (AGG), which has more than $74 billion under management. However, when it comes to high-yield U.S. corporate bond ETFs, it is the fourth-largest out of 25 covered by ETF.com. More importantly, of the 25, it's tied for the highest FactSet rating at A-.

Why would someone want to own HYLB?

First, it has a relatively inexpensive management expense ratio of 0.15%, which gives investors a diversified portfolio of more than a thousand corporate bonds. It also yields 4.8%, which is excellent considering the Fed's benchmark rate is expected to be near 0% for at least the next couple of years.

Not only does it have a high rating from FactSet, but it also has a four-star rating from Morningstar based on its performance over the trailing three-year period. (HYLB listed in 2016.)

Lastly, most of the bonds are rated BB or B (the two highest tiers of junk) by the major credit rating agencies.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Starbucks BOGO and New Sweet and Spicy Drinks

Starbucks BOGO and New Sweet and Spicy DrinksFor a limited time, Starbucks is announcing four new "swicy" drinks that are both spicy and sweet.

By Kathryn Pomroy Published

-

Stock Market Today: Dow Slips After Travelers' Earnings Miss

Stock Market Today: Dow Slips After Travelers' Earnings MissThe property and casualty insurer posted a bottom-line miss as catastrophe losses spiked.

By Karee Venema Published

-

Warren Buffett Stocks: Analyzing The Berkshire Hathaway Portfolio

Warren Buffett Stocks: Analyzing The Berkshire Hathaway PortfolioThe Berkshire Hathaway portfolio is a diverse set of blue chips and some lesser-known growth bets. Here, we look at all stocks picked by Buffett and his lieutenants.

By Dan Burrows Published

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

By Jeff Reeves Published

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

By Nellie S. Huang Published

-

Where To Invest Your 401(K)

Where To Invest Your 401(K)Knowing where to invest your 401(k) money can be difficult. Here, we rank 10 of the largest retirement funds.

By Nellie S. Huang Published

-

Is A Recession Looming? Two Big Bank CEOs See It That Way

Is A Recession Looming? Two Big Bank CEOs See It That WayRecession is likely, Citi's CEO told a Senate panel today, a sentiment echoed by JP Morgan's chief executive last week.

By Joey Solitro Published

-

More Signs of Belt-Tightening and a Slowing Economy: The Kiplinger Letter

More Signs of Belt-Tightening and a Slowing Economy: The Kiplinger LetterThe Kiplinger Letter Although fewer banks are tightening lending standards, more businesses and households are feeling the squeeze.

By Rodrigo Sermeño Published

-

6 Best Books on Investing

6 Best Books on Investinginvesting Those looking to build their wealth should consider these best books on investing.

By Coryanne Hicks Published

-

The Era of Super-Low Interest Rates Could Be Over: The Kiplinger Letter

The Era of Super-Low Interest Rates Could Be Over: The Kiplinger LetterThe Kiplinger Letter We’re likely never going back to the historically low rates that prevailed in late 2019 and early 2020.

By David Payne Published