3 Great Reasons Why You Should Start Saving Early

Once you see what you could gain by stuffing your piggy bank now (and the potential riches you’re giving up by waiting), you'll see why there really is no time like the present.

Our clients often ask “How much do I need to save this year to be on track for retirement?” Obviously, there are a lot of variables that go into answering that question: retirement spending, assumed rate of return, pensions and Social Security to name a few. But perhaps the most important variable is the one that’s priceless: time.

People with the most time on their side are those most likely to achieve their retirement goals. Those who save early end up way ahead of their procrastinating peers.

You may have heard the wise Chinese proverb that says "The best time to plant a tree was 20 years ago. The second-best time is now." The same is true for saving. While the best time to start saving may have been 20 years ago, don't fret, there are ample benefits to starting to save today.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Let's look at a few of the most important reasons.

Time is Money

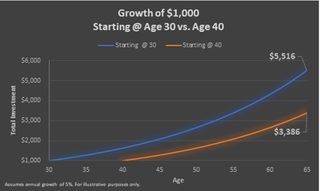

There are few forces as impressive and powerful as compound interest. The real secret to compound interest is less about the amount that is saved, and more about the amount of time it is invested. Let's compare saving $1,000 at age 40 versus age 30 with a hypothetical 5% compound annual return to age 65.

The 30-year-old saver ends up with over 60% more money simply because she saved 10 years earlier.

Instead of just investing $1,000 one time, what if you saved $1,000 per year from 40 to 65 versus starting at age 30?

In this example by starting 10 years earlier you have almost double the final amount at age 65!

The earlier you start the more magical compound interest is.

Opportunity Lost

What if you don't save for the first several years or decades of your career but save massive amounts of money later in retirement? Will that balance things out? Maybe, but there are some opportunities lost.

First, if you have an employer-sponsored retirement plan like a 401(k) that offers an employer match, those dollars are forever lost each year that you don't contribute. If you start saving later, you can't go back to your employer and ask that they give you the lost matching dollars from earlier in your career. Employer matches are free money: Never leave that on the table.

Another consideration is IRS maximum contribution amounts. All tax-advantaged retirement vehicles like 401(k)s, IRAs, etc. have maximum contribution limits each year. For example, in 2019 you can contribute $6,000 into a traditional IRA or a Roth IRA. If you don't make that contribution by the tax-filing deadline next year, that's a lost opportunity and no matter how much money you want to save in the future, you can't get that IRA contribution opportunity back. Yes, you can still save, but you'll have to choose less tax-efficient vehicles and that will impact your return and ending value.

We advise our clients to max out their retirement accounts every single year to take advantage of these tax-saving opportunities from Uncle Sam!

Market Trends

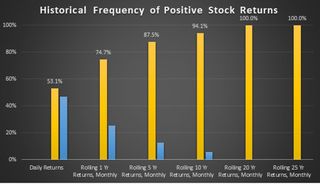

One final advantage I'll point out to saving and investing earlier rather than later is that the stock market presents a much better opportunity for long-term investors than it does for short-term investors. People who invest in the stock market with a short time horizon often get burned and have negative returns. So why then do we invest money for retirement in the stock market? Well, consider the following data.

Between 1928 and 2017, if you had invested in the market any given day, your chances of a positive return were 53.1%; about as good as flipping a coin. As you increase your investment period, your likelihood of a positive return significantly increases. Rolling one-year calendar returns had a 74.7% occurrence of positive returns, and rolling 10-year periods were positive 94.1% of the time! Once you increase the time period to 20 years, there were no negative return periods!

Source: Global Finance Data Inc. as of 12/31/2017. Based on historical S&P 500 returns over various periods. Daily return data begins on 01/31/1928, and based on price appreciation only.

Although nothing is ever guaranteed when it comes to investing, history shows that the longer you are invested, the greater your chance for favorable returns. I've heard it said that what truly matters in investing is not timing the market but time in the market. Get money invested early so your time horizon is long enough to ride out short-term volatility in pursuit of long-term gains. You can sum it all up like this:

- The longer your money is invested, the more compounding you experience.

- There are specific retirement savings opportunities offered each year that may be forfeited if not acted on.

- And the stock market should be viewed as a long game, not a quick turnaround.

Because of these reasons, you should start saving today. Even if you can't save as much as you need to right now, start with something. Get some money working for you and get time on your side. Don't let another year go by lamenting that you haven't started planting financial trees. Besides, today is the second-best time to start!

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Josh Monroe is a CERTIFIED FINANCIAL PLANNER™ practitioner and a Chartered Financial Consultant designee who listens actively and plans thoughtfully to help clients achieve their goals. He joined the CI Brightworth team in 2019 as a Financial Planner. Before CI Brightworth, Josh spent eight years at a leading insurance and investment firm in a variety of roles, including compliance and supervision. Josh is passionate about financial planning and making complex concepts easy to understand.

-

Is a Phased Retirement Right for You?

Is a Phased Retirement Right for You?Want to keep working, just not as hard? A phased retirement may just be the answer.

By Kimberly Lankford Published

-

Four Tips to Make Your Sales Presentation a Winner

Four Tips to Make Your Sales Presentation a WinnerBeing prepared and not being boring can go a long way toward persuading a potential customer to buy into what you’re offering.

By H. Dennis Beaver, Esq. Published

-

Four Tips to Make Your Sales Presentation a Winner

Four Tips to Make Your Sales Presentation a WinnerBeing prepared and not being boring can go a long way toward persuading a potential customer to buy into what you’re offering.

By H. Dennis Beaver, Esq. Published

-

Pros and Cons of Waiting Until 70 to Claim Social Security

Pros and Cons of Waiting Until 70 to Claim Social SecurityWaiting until 70 to file for Social Security benefits comes with a higher check, but there could be financial consequences to consider for you and your family.

By Patrick M. Simasko, J.D. Published

-

Now Could Be Time for Private Investors to Make Their Mark

Now Could Be Time for Private Investors to Make Their MarkThe venture capital crunch may be easing, but it isn't over yet. That means there could be direct investment opportunities for private deal investors.

By Thomas Ruggie, ChFC®, CFP® Published

-

How to Stop Boredom From Ruining Your Happy Retirement

How to Stop Boredom From Ruining Your Happy RetirementRetirees who explore new interests and have an active social life are more likely to find joy — and even greatness — in the newfound freedom of retirement.

By Richard P. Himmer, PhD Published

-

The Life-or-Death Answers We Owe Our Loved Ones

The Life-or-Death Answers We Owe Our Loved OnesHow our life ends isn’t always up to us, but that question too often must be answered by loved ones and health care workers who don’t know what we would want.

By Joel Theisen, RN Published

-

Hot Tips for Home Buyers and Sellers Right Now

Hot Tips for Home Buyers and Sellers Right NowReal estate looks to be especially hopping this spring, thanks to pent-up demand and buyers adjusting to higher mortgage rates. Here’s how you can prepare.

By Pam Krueger Published

-

Is 100 the New 70?

Is 100 the New 70?Eating well, exercising, getting plenty of sleep and managing chronic stress can help make you a SuperAger. Funding that long life requires longevity literacy.

By Phil Wright, Certified Fund Specialist Published

-

Nine Lessons to Be Learned From the Hilton Family Trust Contest

Nine Lessons to Be Learned From the Hilton Family Trust ContestDisclaimers, good communication, post-marital agreements and more could help avoid conflict in a family after the owners of a wealthy estate pass away.

By John M. Goralka Published